Bitcoin’s current market cycle is challenging historical patterns, leaving experts divided on its future trajectory. Veteran trader Peter Brandt has raised concerns about the possibility of Bitcoin having already reached its cycle top, while other analysts maintain a bullish outlook. This divergence in expert opinions has sparked intense debate within the cryptocurrency community.

Breaking the Mold: Bitcoin’s Longest Post-Halving ATH Wait

Peter Brandt, renowned for his accurate prediction of the 2017 Bitcoin collapse, has identified a unique characteristic of the current Bitcoin market cycle. According to Brandt, this cycle is on track to become the longest post-halving period in Bitcoin’s history without reaching a new all-time high (ATH).

“The current 2022-2025 cycle may soon mark the longest stretch in Bitcoin’s history without hitting a new all-time high following a halving,” Brandt noted in his analysis.

This observation stands in stark contrast to previous cycles:

- 2011-2013 cycle: New ATH in just 8 weeks

- 2015-2017 cycle: New ATH after 24 weeks

- 2018-2021 cycle: New ATH in 25 weeks

- 2022-2025 cycle: No new ATH after 23 weeks (as of the time of writing)

Brandt’s Bearish Outlook: Exponential Decay Theory

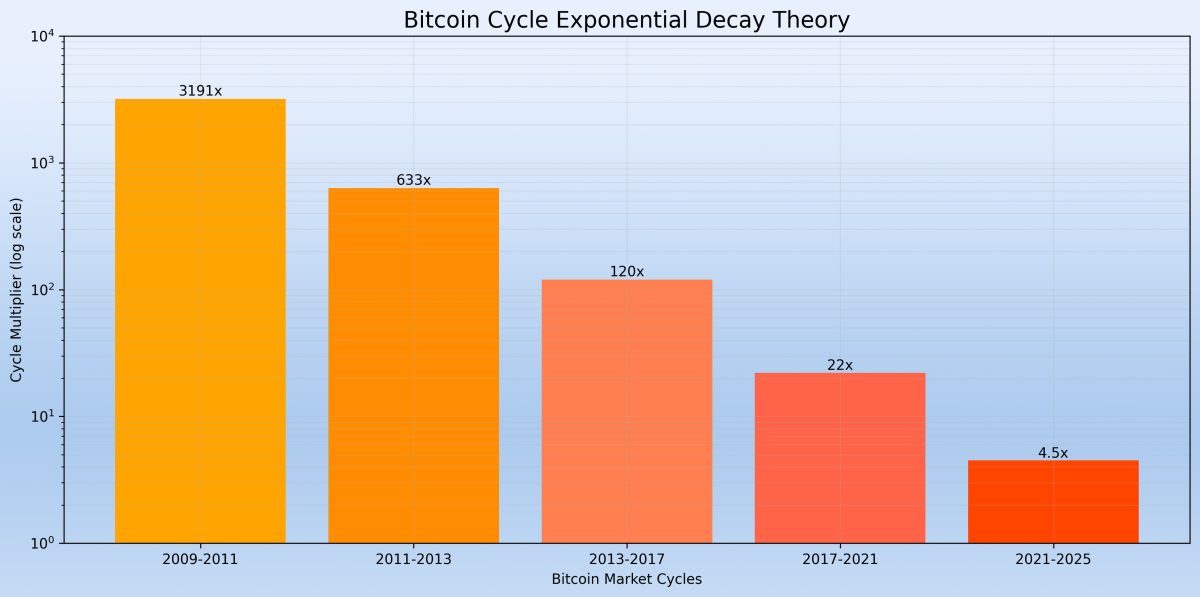

Adding to his cautious stance, Brandt introduced the concept of “Exponential Decay” in Bitcoin’s market cycles. He suggests that each cycle since 2011 has lost approximately 80% of the force of the previous one.

Based on this theory, Brandt projects:

- A 25% chance that the current cycle has already peaked

- A potential slide back to the mid-$30,000 range

- A possible 4.5X advance in this cycle, significantly lower than previous cycles

Bullish Counter-Arguments: Analysts Remain Optimistic

Despite Brandt’s warnings, several prominent analysts maintain a bullish outlook on Bitcoin’s future:

- Benjamin Cowen argues that Bitcoin is “on track and in sync with other historical market cycle movements,” suggesting an imminent rally.

- Ki Young Ju, CryptoQuant founder, predicts the next phase of the Bitcoin rally could begin in Q4, citing likely whale actions.

- K33 Research points to recent drops in Funding Rates alongside an uptick in Open Interest rates, describing the market as “ripe for a short squeeze.”

- Glassnode data reveals a reduction in profit-taking by Long-Term Holders (LTH), which historically precedes new price uptrends.

An FYI on $BTC

Current bull market cycle in $BTC will soon become the longest time post halving in history for a new ATH

or,

Could indicate that new ATH is not in the cards pic.twitter.com/jkeboVAGtp— Peter Brandt (@PeterLBrandt) August 21, 2024

Market Indicators: Mixed Signals

While the debate rages on, several market indicators are sending mixed signals:

- Bitcoin is currently trading within resistance around the $62,000 mark.

- A major obstacle at $73,804 needs to be cleared for a new ATH.

- BTC inventory on OTC markets has increased to a two-year high, potentially suppressing short-term recovery.

- An expanding triangle pattern is forming on Bitcoin’s charts, but remains incomplete.

Conclusion: The Waiting Game Continues

As Bitcoin navigates this unprecedented market cycle, the cryptocurrency community remains divided on its future direction. While Peter Brandt’s analysis suggests caution, other experts see potential for significant gains ahead.

For now, the market remains in a holding pattern, with traders and investors eagerly watching for the decisive moment that will determine Bitcoin’s next move. Whether it will break new ground or confirm Brandt’s bearish outlook remains to be seen.

As this situation develops, market participants are advised to conduct thorough research and consider multiple perspectives before making investment decisions.