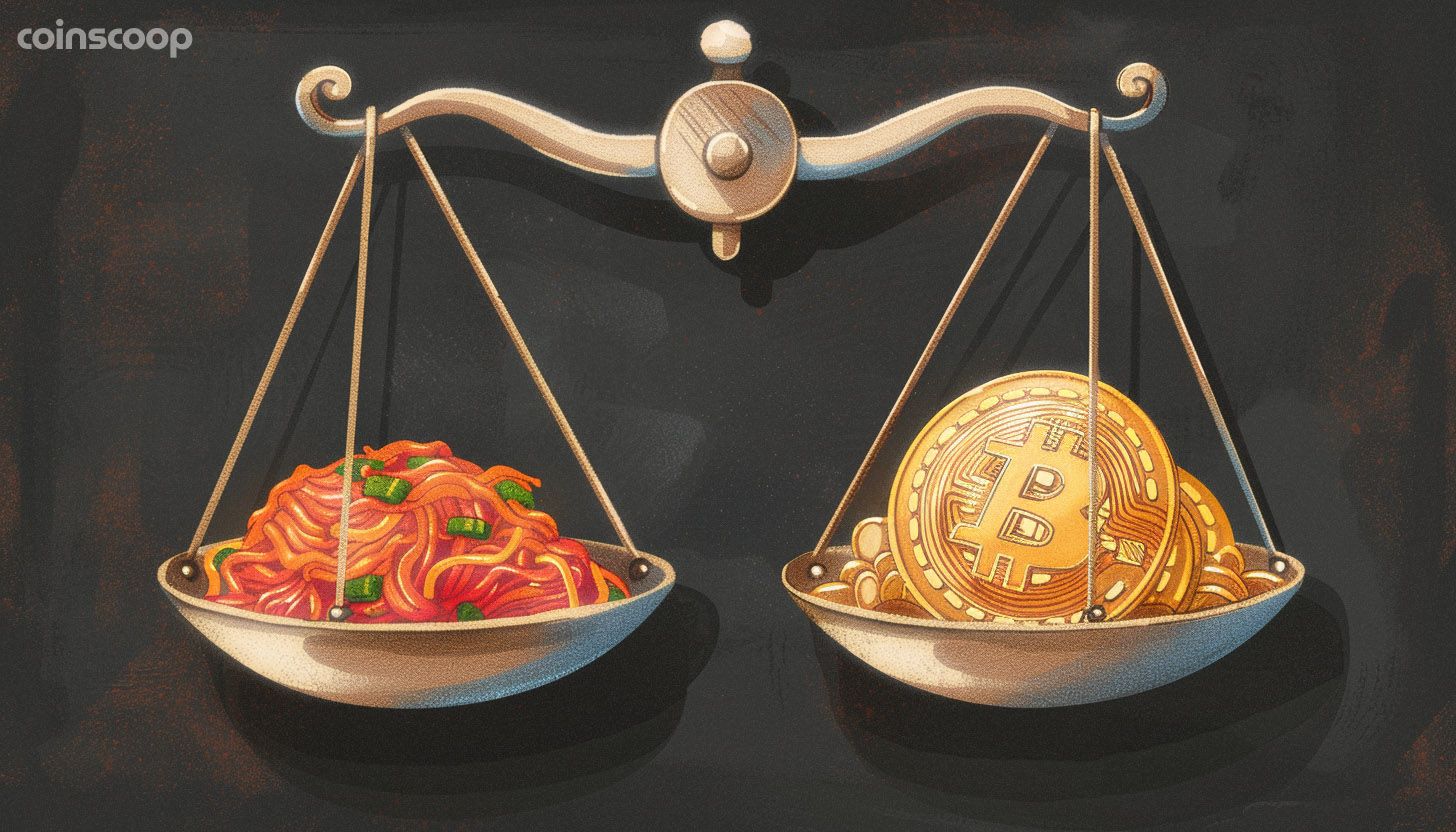

The kimchi premium is a term used to describe the significant difference in cryptocurrency prices, particularly bitcoin, between South Korean exchanges and foreign exchanges. This phenomenon has drawn attention to the unique characteristics of the South Korean cryptocurrency market. The price of bitcoin on South Korean exchanges has been known to be up to 50% higher than on exchanges in other countries, creating a unique arbitrage opportunity for traders.

History of the Kimchi Premium

The kimchi premium first gained attention in 2017 and early 2018 when the bitcoin price difference between South Korean and foreign exchanges reached its peak. In January 2018, the premium surpassed 50%, meaning that bitcoin was trading significantly higher in South Korea than in other markets.

Several factors contributed to the emergence of the kimchi premium, including:

- South Korea’s strong interest in technology and online gambling

- A lack of other high-return investment opportunities in the country

- Capital controls and financial regulations in South Korea

Kimchi Premium Arbitrage

Arbitrage trading is a strategy that involves taking advantage of price discrepancies across different markets. In the case of the kimchi premium, traders could potentially profit by purchasing bitcoin on foreign exchanges at a lower price and selling it on South Korean exchanges at a higher price, effectively engaging in cross-border cryptocurrency trading.

For example, if the price of bitcoin on a U.S. exchange is $10,000 and the price on a South Korean exchange is $15,000, a trader could buy bitcoin on the U.S. exchange and sell it on the South Korean exchange, pocketing the $5,000 difference. However, cryptocurrency arbitrage opportunities are not without their challenges, as we will discuss later.

Factors Contributing to the Kimchi Premium

Several factors have played a role in the development and persistence of the kimchi premium:

- South Korea’s tech-savvy population and interest in online gambling have led to a high demand for cryptocurrencies.

- A lack of alternative high-return investment opportunities in the country has driven investors towards the crypto market.

- Capital controls and financial regulations in South Korea have made it difficult for investors to move funds in and out of the country, creating a somewhat isolated market. These controls have contributed to the cryptocurrency market inefficiencies that give rise to the kimchi premium.

- Anti-money laundering laws have further complicated the process of trading cryptocurrencies across borders.

Restrictions and Challenges in Exploiting the Kimchi Premium

Despite the profit potential, exploiting the kimchi premium is challenging. Investors face several hurdles when attempting to take advantage of the price difference:

- Domestic restrictive policies in South Korea require investors to follow strict regulations and have overseas transfers to buy cryptocurrency on foreign exchanges.

- Anti-money laundering laws in South Korea aim to prevent exchanging and trading illegally obtained cryptocurrency.

- Foreign investment policies prohibit non-domestic traders from doing business on South Korean exchanges, limiting the inflow of funds from other countries.

- The complexity of transactions, such as the need to open a new bank account for foreign exchange, can discourage investors from engaging in arbitrage trading.

Current Status and Future Outlook

As of 2024, the future of the kimchi premium remains uncertain, as it is influenced by various factors such as market demand, regulatory changes, and global economic conditions.

Recent developments, may impact the kimchi premium in the coming months and years. As the cryptocurrency market continues to evolve, it will be interesting to observe how the kimchi premium responds to these changes.

In conclusion, the kimchi premium is a fascinating phenomenon that highlights the unique characteristics of the South Korean cryptocurrency market. While arbitrage opportunities exist, investors must navigate a complex landscape of regulations and challenges to successfully exploit the price difference. As the market continues to mature, it remains to be seen how the kimchi premium will evolve and impact the global cryptocurrency landscape.